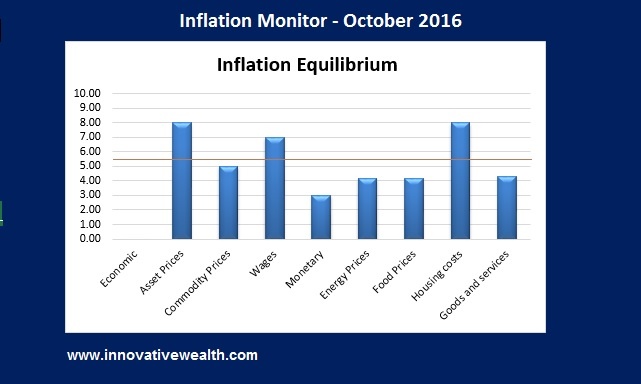

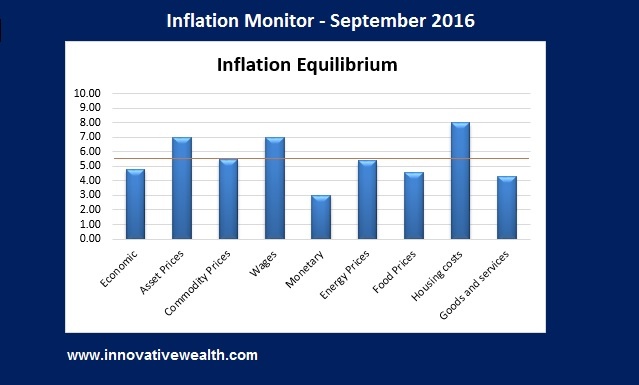

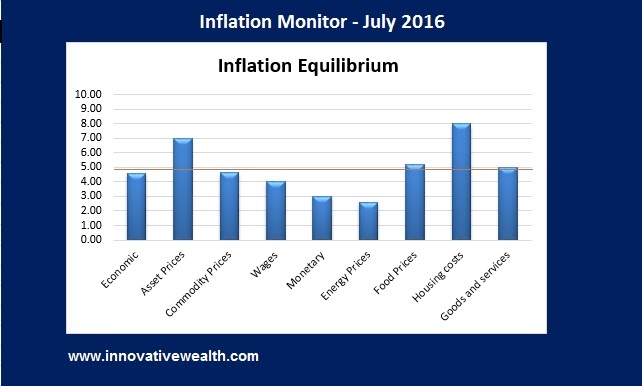

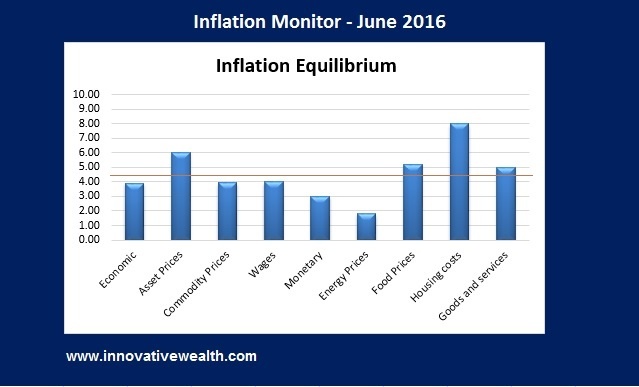

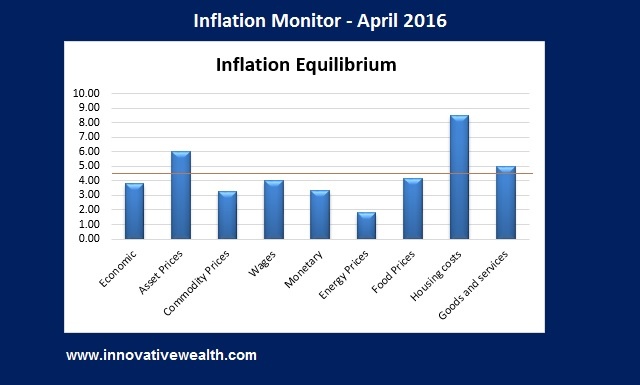

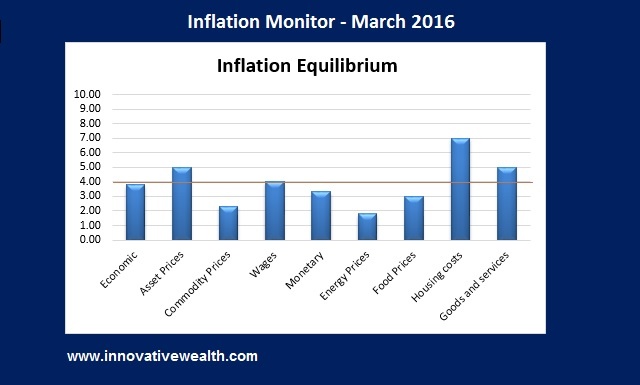

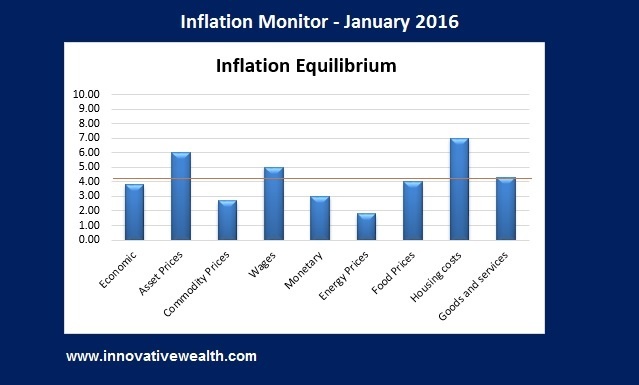

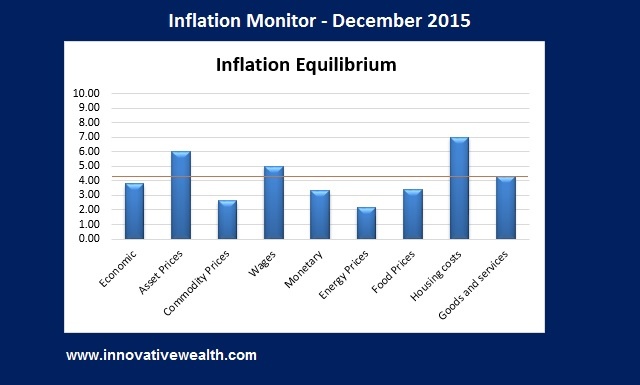

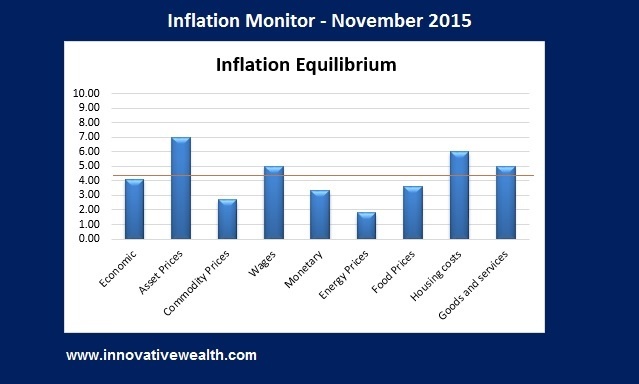

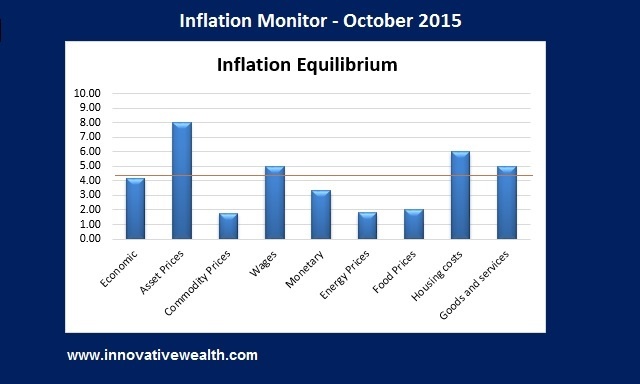

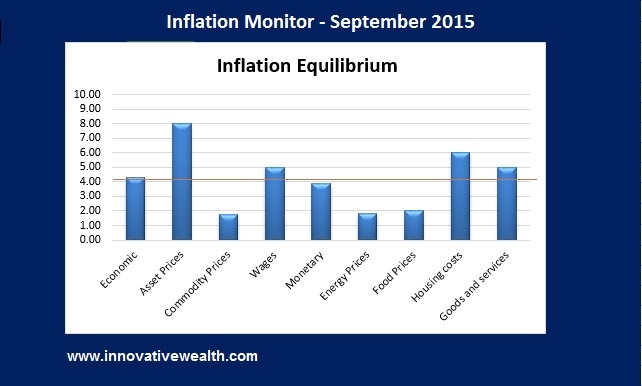

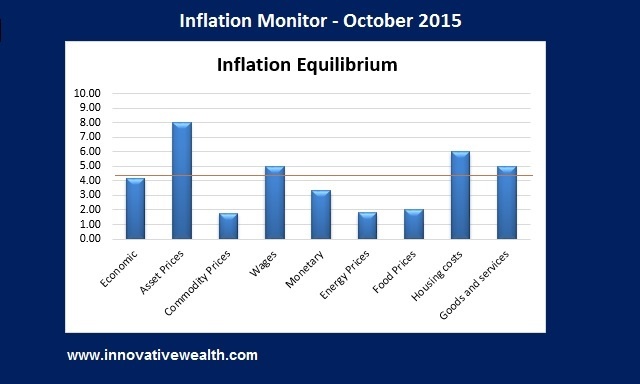

Inflation Monitor Summary – Composite Ranking

* The Inflation Equilibrium is a quick summary for the whole data series of the inflation monitor. If you don’t like statistics, this is the chart for you.

Inflation Monitor – October 2015 – Introduction

The last month has been really interesting. My prediction seems to be coming true. I have stated for most of this year that the second half (3rd or 4th quarter) of this year would show the US entering into a recession. While I still believe that the US has a strong economy relative to the rest of the world. There are just too many factors bringing it down.

The powerful people in this country as well as many academic economists have been pushing for a more global economy for a few decades. Now that we have a more global economy, it is more interconnected than ever. With the benefits of this type of system, come drawbacks. Having global booms and busts is one of those symptoms.

Despite what the media personalities say on TV, the US is not an island. The US cannot decouple their economy from the rest of the world. I am not aware of this happening in any meaningful way for the past few decades. Prior to that, the global economy was not as interconnected, so any data would be less relevant. I have not looked at prior data, but I assume it has a similar theme to what we have now.

What is important to remember is that the global economy is interconnected by money flows, relative currency valuations, asset valuations, inflation, jobs and many other factors. Most countries are dependent on one or more other countries for their economic prosperity. Unless the worlds nations decide to get into a economic battle as they did going into the great depression, this dependency will not change.

While this service is called the inflation monitor, it is important to discuss the economy as well since it has such an important bearing on inflation and deflation. But as you know if you have been reading this for any amount of time, most of what is driving inflation or deflation at the moment is debt.

I do not want to be hyperbolic, but the debt bubble that exists today is extremely dangerous and when it pops, a huge amount of wealth will be destroyed. While this bubble can be managed, as it has been up to this point, the Fed is not strong enough to control the global economy’s debt.

There is one point I want to leave you with. Bear markets are dangerous, they are not a time to “make money”. The most important thing you can do in a bear market is to “not lose money”. Depending on the nature of it, this might be harder than you imagine. Logic does not always prevail in a bear market. 2008-2009 should have taught you that lesson, please go back and refresh you memory.

Read More…